People in america Is actually Building Vacation-Family Empires with Effortless-Money Financing

(Bloomberg Markets)-Brenna Carles pushes together a winding country street throughout the High Smoky Slopes, a get-steeped a property podcast to tackle on the speakers out of the lady brand name-the Lincoln SUV. Lately, Carles try belting out tunes at Nashville honky-tonks as she struggled to make it since the a country musician. Today, during the 32, the woman is one Read Full Report of several region’s really winning mortgage brokers specializing in loans getting trips household rentals.

Carles, exactly who started the woman company lower than a year ago, states the woman is ashamed so you’re able to know just how much she is clearing these days: $one hundred,100 1 month, bring or take, focused to make $1 million this current year. Some one inquire just how much We build a-year, We you will need to rest now, given that I think anybody wouldn’t believe it, she states.

For as long as the business allows, agents, loan providers, and you can traders try cashing for the to the home growth when you look at the America’s best vacation spots. It tend to be Carles’s turf, close Dollywood motif park into the Pigeon Forge, Tenn., together with parts as much as Disney areas, Colorado skiing lodge, and you will Gulf of mexico beaches within the Tx and Alabama. It’s a simple-broadening and you may possibly risky company, especially now, because market cools because of high interest levels.

Just last year financial support-possessions financing as opposed to taxpayer backing totaled $nine

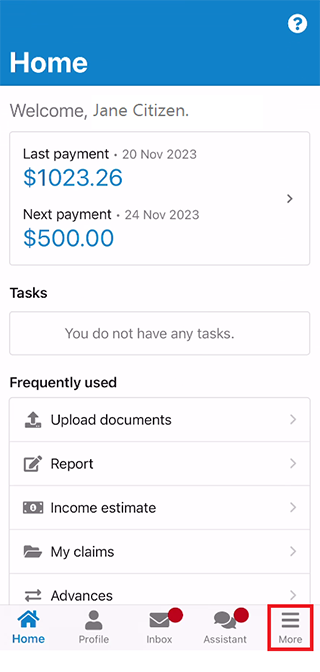

Landlords possess come up with mini empires, controlling her or him regarding afar using smartphone applications. App designers, middle professionals, teachers, armed forces employees-actually TikTok influencers-flood social media with stories off newfound money. These are generally taking upwards features, will sight-unseen away from out-of county, at once unheard-out-of costs. Certain longtime citizens whine that these investors is modifying the smoothness of the teams and to make its construction unaffordable.

A new version of team mortgage is fueling brand new boom. It allows individuals, such as the worry about-functioning, qualify created not on their wages however, on projected upcoming earnings of the house they’re to invest in. Inside the industry slang, they might be also known as loans provider visibility proportion finance, speaking about the way that rents need to be at least sufficient to fund monthly mortgage repayments. 9 million, an eightfold boost just like the 2018, considering globe book Inside Mortgage Finance’s investigation out-of mortgage thread choices. The vast majority licensed due to rental income.

But, for the past 12 months, much more loan providers have started enabling borrowers be considered based on whatever they expect to costs a night for remains set aside for the internet sites such as for example since Airbnb and you will Vrbo, an effective tool off take a trip providers Expedia Category Inc. Real estate buyers can be make so much more income renting a property aside getting a lot of money a night than they might owing to a rental so you can a long-identity tenant, about for now. Very manage-getting citizens, a few of just who try more youthful and just starting, can afford even more expensive possessions.

Regular-expenses clients for the much time-identity renting support a few of these money, industry managers and you will experts say

Chelsey Jones, a 29-year-dated previous supermarket director during the Columbus, Kansas, purchased four renting on the Smokies, about three that have Carles’s assist. Throughout, Jones has borrowed $1.one million over the past 12 months to have services like Large Bear Lookout, a four-bedroom cabin inside the Gatlinburg, Tenn., that have shuffleboard, a spa, and you will a keen arcade.

To start with it’s difficult to imagine how Jones you will pay for Huge Incur. The fresh month-to-month mortgage repayment is actually $dos,600; lease regarding a reliable, long-label renter perform barely security it, aside from fixes and repairs. But Jones normally book the home for typically $350 every night toward Airbnb. This way, she can secure from the $six,100 thirty days, over double this lady financing commission.

Jones needs to make a great $150,100 finances this current year from her rental attributes: her Smokies property, along with one in Kansas as well as 2 a whole lot more significantly less than framework in the Fl. That’s almost 4 times over she attained inside her grocery employment, and that she quit when you look at the 2019. Exactly what an aspiration become a reality to be able to performs from house, getting my personal workplace, and work out that type of money, claims Jones, who today plus functions because a realtor.