Obtaining a mortgage due to the fact a company

If you act as a specialist, the majority of these will also apply to your. Just as in other-self-working anyone, loan providers would be in search of signs of long-title defense – if you can produce a continuous agreement with an employer, or proof earlier in the day arrangements that are probably be renewed, this could help make your software more desirable.

When you are delivering holidays ranging from stints is one of many benefits away from employing, minimise time away at the forefront-to buying property loan providers could be cautious if they view you out of work for more than 7 days in the a beneficial twelve-month several months.

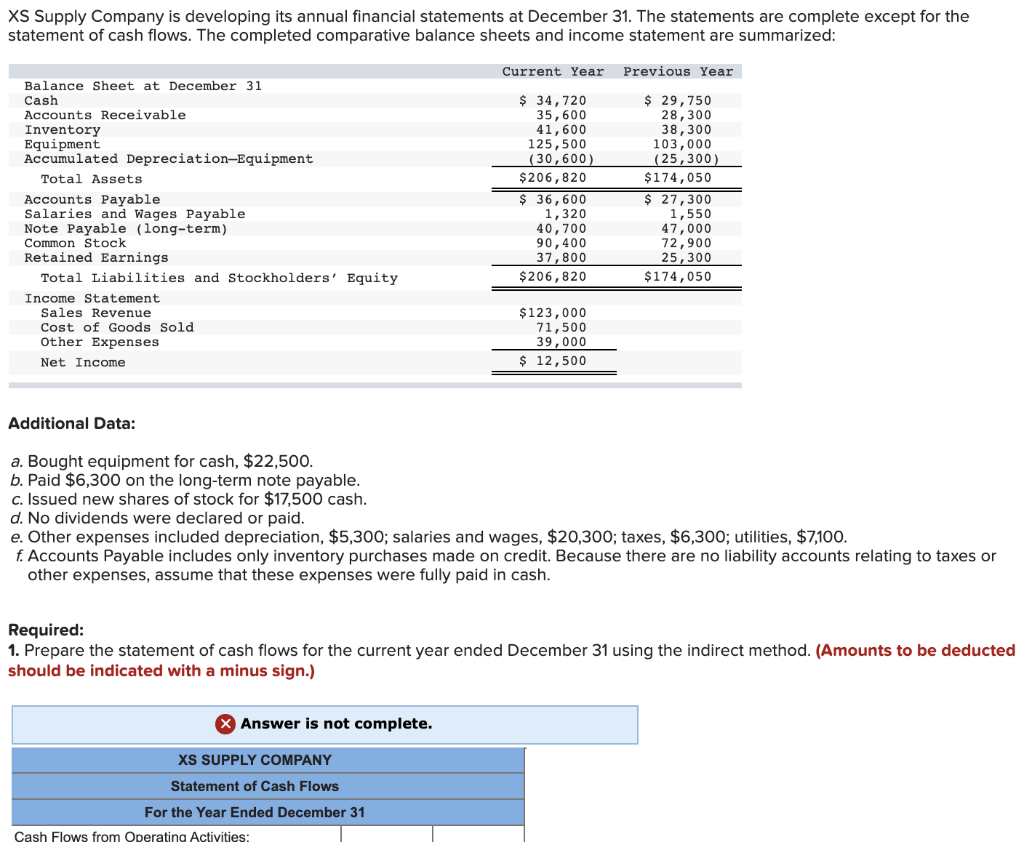

Exactly how loan providers determine date rates

Certain lenders tends to be prepared to assess your own yearly money towards the the cornerstone of one’s day rate, when you may require good a dozen-week bargain for it getting a choice.

Loan providers will take your day-to-day price and you can multiply they by number of days you usually really works each week, after that multiply one out over a complete year. Remember that loan providers might want to cause for people holidays and you will gaps ranging from agreements, very most usually assume you just really works between 46 and you will forty eight days a-year.

In case your day price was ?eight hundred and also you fundamentally really works five months each week, your estimated yearly earnings is as much as ?76,800.

- ?400 x 4 months = ?step 1,600 a week

- ?step 1,600 x 48 months = ?76,800

Tips change your chances of being accepted

Getting a mortgage isn’t an effective five-minute employment; it’s good for prepare for a loan application far ahead of time away from and also make that. You might alter your possibility of getting hired correct the original go out by simply following these tips.

Explore a keen accountant

It’s vital to employ an authorized otherwise chartered accountant to arrange their membership. Actually, particular loan providers wouldn’t think applications out of thinking-operating those who do not have upwards-to-day membership signed out of by an accountant.

Its well worth bearing in mind, not, that even though it is well-known to have accountants so you can lawfully minimise the proclaimed income so you pay faster tax, this could enjoys a bad perception once you get a good mortgage, as your accounts will show a smaller funds.

Complete three SA302 versions

SA302 versions give annual taxation calculations, and most loan providers tend to inquire about about three (that for every single of history 36 months) after you sign up for a home loan. That being said, certain lenders need several.

If you have sent oneself-research taxation statements on the internet, you could potentially print out-of their SA302 computations. For people who recorded your membership because of the blog post, you’ll need to get in touch with HMRC and permit doing two weeks to suit your variations to reach.

Rescue a larger put

As with any home purchase, the larger the fresh new deposit you’ve got, the easier it is so you can safer a mortgage during the an effective rate. Very loan providers need in initial deposit of at least ten% from notice-working individuals, just in case you don’t need a lengthy history of accounts, you will need a larger deposit so you’re able to persuade a lender one to you might be a safe choice.

Get money in order

Earliest, improve your credit loans in Winfield history if you are paying from any expense just since they might be owed, closing dormant accounts, ensuring there aren’t any wrong entries in your credit report and you will delivering toward electoral move.

It’s also advisable to be careful concerning your paying models throughout the season before applying, given that most of the regular outgoings would-be considered by your financial.

Capture elite group financial advice

For individuals who apply for a mortgage as well as the bank rejects your, it could be registered on your own credit reports. This can destroy your credit score and you will, consequently, make it not likely that you will get accepted by second bank your connect with.