That said, particular lenders could be wary about down payments financed of the household guarantee funds or HELOCs

- Email icon

- Myspace symbol

- Facebook symbol

- Linkedin icon

- Flipboard symbol

Exactly what are the pros and cons off HELOCs and you can family security funds?

Tappable household equity has become from the an archive higher – Black Knight rates the mediocre citizen is sitting on $185,000 from inside the collateral – and you may mortgage rates, no matter if up a bit, are still close historical lows (no matter if of several experts manage anticipate they rise a lot more inside the 2022). Which is leading certain homeowners in order to question: Do i need to use a property guarantee otherwise HELOC to fund one minute domestic right here? Here’s what you have to know earliest, and you will see the most recent house collateral and you can HELOC prices you can be eligible for right here.

Residents which have a surplus off collateral inside their no. 1 house just who need to pick an extra home are able to use a property security loan otherwise personal line of credit to take action, shows you Greg McBride, head monetary specialist to have Bankrate.

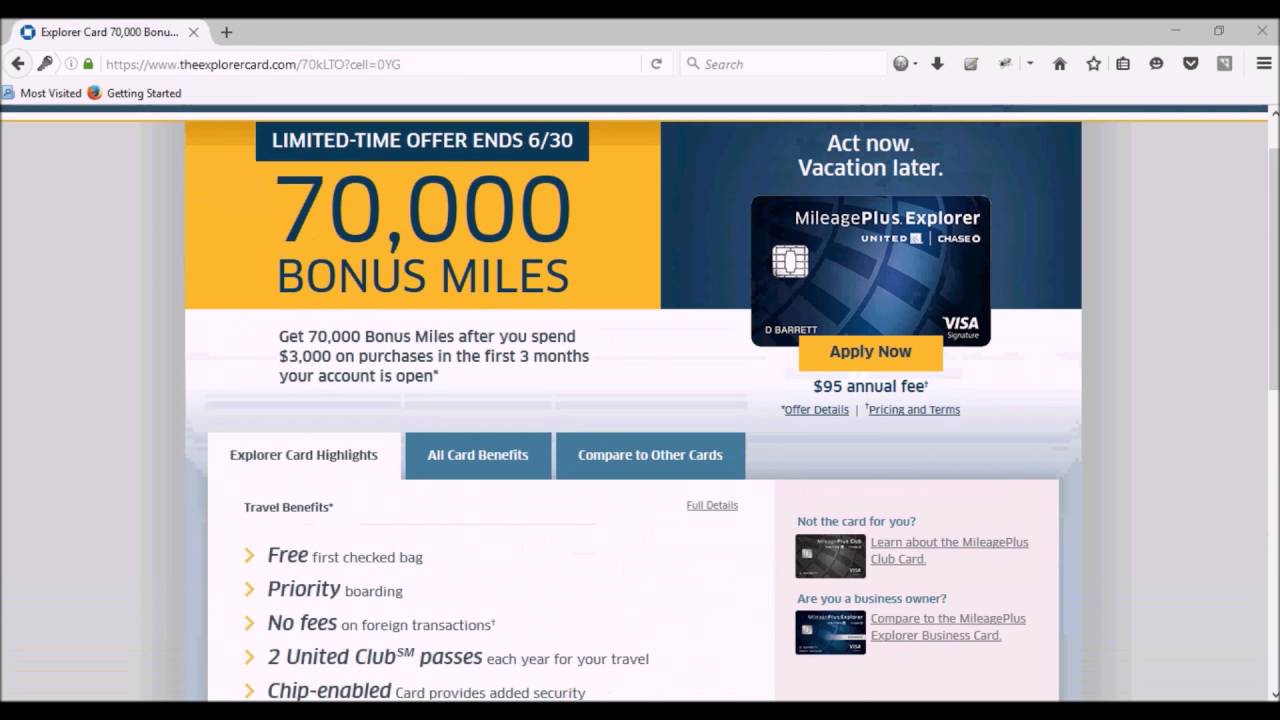

Given that rates for the next residential property are frequently greater than mortgage loans getting no. 1 belongings, Holden Lewis, domestic and you can financial expert at the NerdWallet, states if you possibly could score property equity loan on your own first home on a lesser interest rate, then it might make experience to finance the second home you to definitely ways – or perhaps to finance the latest down-payment. And you may McBride contributes one to playing with family guarantee can get really works including better in the event the second residence is something like a tiny trips family otherwise cottage where taking home financing may possibly not be best value or possible. But before you take the latest dive, chat to an enthusiastic accountant knowing how this will affect the taxation write-offs. You might find you’ll get better taxation cures that with a simple financial to shop for another family, claims Lewis.

Using a property collateral financing are beneficial for a straight down fee if you find yourself to acquire another household inside the a very competitive area and you should take on all of the cash consumers (you will see the fresh household guarantee and you can HELOC costs you can also be qualify for here). Playing with equity effectively produces a purchaser more appealing since they’re ready to put cash off and increase its to find fuel. In addition, house collateral loans are apt to have lower rates of interest than simply of a lot other types of fund, definition it can be a less expensive cure for borrow money.

In order to be eligible for a mortgage for the an additional domestic, loan providers generally speaking require a loans-to-income (DTI) proportion off 43% otherwise shorter – so significantly more loans on the equilibrium layer may well not are employed in their choose. To assess your own DTI, https://paydayloansconnecticut.com/mansfield-center/ make sense all your monthly bills and you will divide the total by the gross monthly income.

Opting for property security mortgage or HELOC comes with caveats. While you are domestic rich and money terrible and you end up being unable to make an installment in your loan, the lender can also be foreclose your home. What’s more, sometimes, individuals is only able to access up to 80-85% of your own collateral in their priple, should your home is well worth $400K and you owe $300K, you have got $100K in security where you might use $85K.

As with other sorts of fund, family equity loans try at the mercy of running into costs such as for instance settlement costs, and therefore normally consist of 2% to help you 5% of amount borrowed – that’s the reason it could be advantageous to keep in touch with an effective economic planner or adviser concerning benefits and drawbacks certain in order to your situation.

Is another types of investment a second home much better than an excellent HELOC otherwise house security financing?

Home loan rates towards the 2nd property are greater than to possess prominent homes, however for people having proper advance payment the fresh new markup is limited, which will build a vintage financial the more attractive channel, says McBride.

Also, if you are to get an additional where you can find generate income, McBride states, Investors to buy local rental property commonly love to financing they really, and you can separate using their principal residence to own income tax or responsibility intentions.

On the other hand, playing with a house guarantee mortgage to find an extra domestic happens having masters including and also make the give significantly more competitive – and you may increasing your recognition chance just like the playing with guarantee is seen while the much safer to have loan providers, considering the collateral on the line.

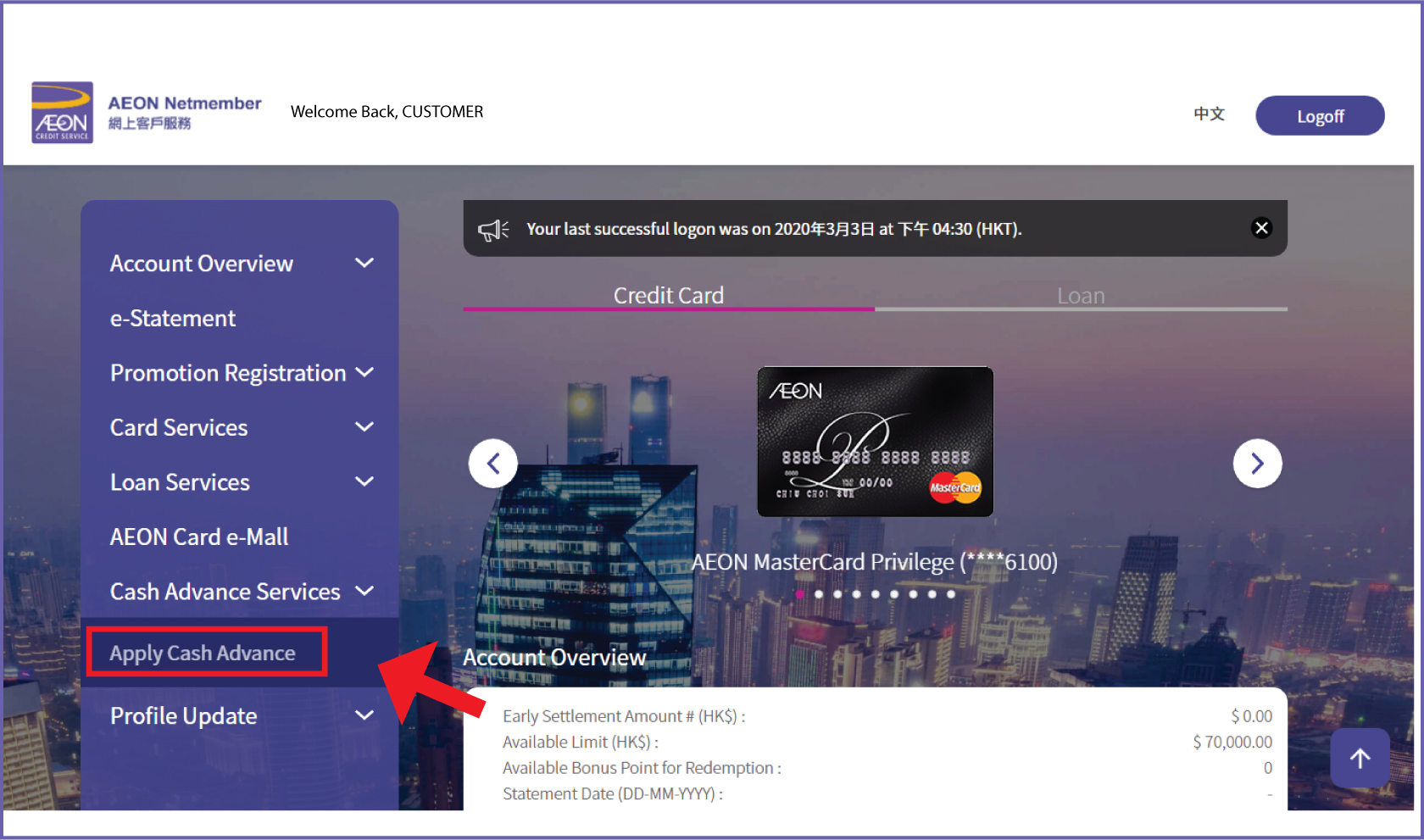

Getting a HELOC otherwise family guarantee mortgage

Even though you provides proper amount of equity on the primary house, qualifying having property guarantee mortgage doesn’t solely rely on the level of guarantee available. Loan providers envision credit scores, income or any other expenses due whenever determining the amount of the latest loan might award. To make certain a prompt exchange, it’s wise so you’re able to preemptively gather files proving your family income having fun with possibly paystubs or W-2s, a house goverment tax bill, a copy of your homeowner’s insurance coverage and personal financial comments. Additionally, it is necessary to research rates with various loan providers, such as the one that holds your existing home loan including banking institutions in which you continue account.

The recommendations, advice or rankings expressed on this page are those out-of MarketWatch Selections, and also have not already been assessed or supported by the our industrial partners.