Money increases tax on the a marketed family

Home loan focus deduction

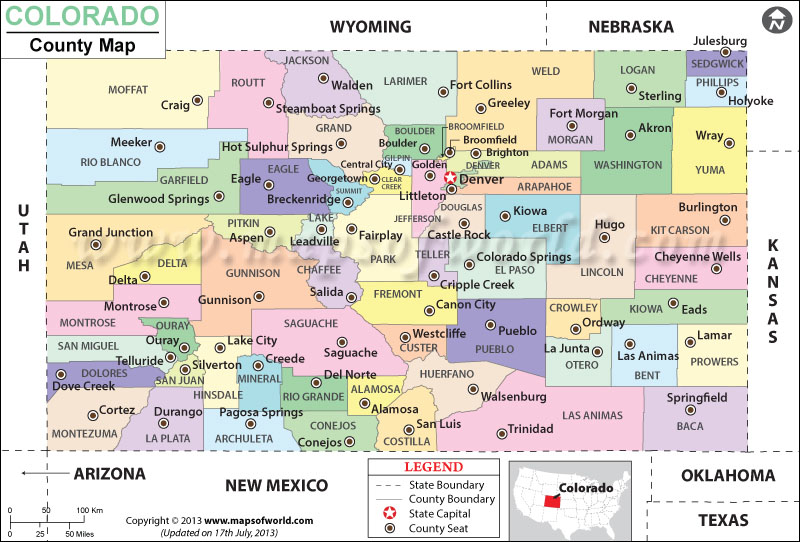

For many who itemize, you could potentially deduct the eye that you paid on the mortgage to suit your basic otherwise next home. New limitations are the same just like the household security loan income tax deduction limits. While you are hitched processing together, desire toward earliest $750,000 out of financial debt is actually allowable. If you’re submitting on their own, new limitation was $375,000. To own mortgages that existed in advance of , this type of ceilings is $one million and you will $five-hundred,000, respectively.

Your home have to serve as security into loan, and you can attract is deductible on your very first and second land. A house is property, an effective condominium, a mobile domestic, a truck, a boat otherwise an equivalent possessions who has got sleeping, preparing and you may bathroom place. You can discover a little more about the loan notice deduction for the IRS’s site.

Office at home deduction

If you are using section of your property to own business, you are capable subtract relevant expenses. Usually, so you can be eligible for that it deduction, a fraction of your house must fulfill several earliest criteria:

Put simply, you must on a regular basis explore section of your property (or a special design on your property, instance a separated driveway) only for doing business, and you need certainly to show that you employ your home as your principal office. (más…)

Comentarios recientes