Benefits and drawbacks from a beneficial USDA Financing

Your earnings can also see whether or not the brand new USDA financing system suits you. Customers need to meet money limits, in order enough time as you qualify given that an incredibly lower to moderate-income earner in your area, you are qualified.

It can be worthy of choosing what other finance you qualify to possess, if any. Constantly, USDA financing consumers can not get financial support through-other function, such as for instance a conventional financial otherwise FHA mortgage. If it means you, it could be sensible to truly envision good USDA mortgage.

Whenever you are there are many positive points to an excellent USDA financial to own the proper applicant, such mortgage loans are not for all consumers. Let us look closer in the advantages and disadvantages out-of the mortgage program:

Advantages regarding a USDA Loan

- 100% investment offered: Saving upwards for a down-payment loans in Blue Ridge will be tough, particularly if a possible homebuyer produces only over otherwise below the average income within their town. USDA loans help individuals score mortgages rather than placing anything off. The new funds don’t have private mortgage insurance criteria, which can help customers save yourself so much more. Since the USDA pledges ninety% of one’s financing mention, the danger so you’re able to lenders are faster.

- Offered to most-lowest and you may low-money consumers: Certified consumers need certainly to secure 115% otherwise a reduced amount of new median money within city to obtain an ensured USDA mortgage. The amount of money constraints to have lead funds and you will home improvement financing and you can provides was actually lower. Brand new fund make it possible for visitors to buy a house who can get or even not be able to become approved for a loan.

- Offered to consumers just who can not score almost every other loans: Also opening up mortgages to those who don’t enjoys high enough profits, the newest USDA financing system enables individuals who are not entitled to conventional or other style of lenders to buy a home. The mortgage system takes away traps including down payments on procedure.

- Fixed-price notice: The interest rate to the a guaranteed USDA loan is fixed getting living of financing. Brand new fixed-rates has the benefit of balances so you can individuals.

- Much time repayment several months: USDA lead funds allow individuals 33 or 38 age to repay the mortgages. The latest 38-12 months title helps to ensure lower-adequate monthly obligations to own suprisingly low-earnings borrowers. Fund the fresh new USDA guarantees features a thirty-year repayment term.

Disadvantages away from a great USDA Financing

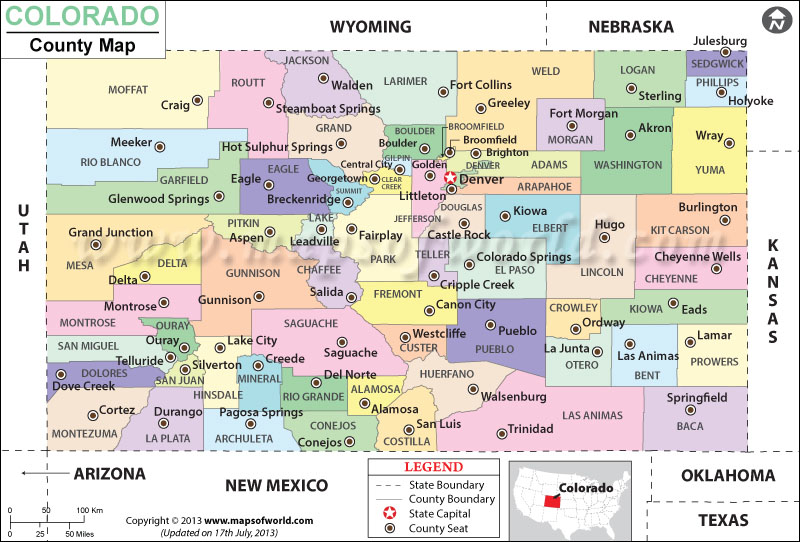

- Constraints to the place: USDA finance are not if you should inhabit places or very setup section. The brand new loans is only for to find a house from inside the outlying otherwise specific residential district section. Since the financing can’t pick land inside the towns and cities for example Bay area, Philadelphia or Nyc, the town you to definitely does qualify for a great USDA loan is almost certainly larger than do you really believe.

- Restrictions for the construction particular: USDA fund need to pay to possess a single-nearest and dearest quarters. The fresh new head financing program features even more limits as compared to secured loan program. Property ordered that have a direct loan need to be small in proportions and cannot has actually within the-crushed pools. For both sorts of loans, brand new borrower has to live-in our home it pick.

- Mortgage constraints could possibly get pertain: Restrictions having an excellent USDA loan are usually predicated on a good borrower’s income and exactly how much capable pay off. Getting lead money, the cost of our home has to be below the restrict set for the area. The fresh new limit is commonly on the $285,000but can be more during the areas which have a top cost of way of life.

Due to the fact fund on lead financing program become from the brand new USDA, people who are eligible and you can wanting applying for you need to incorporate truly courtesy its regional Rural Creativity place of work. The borrowed funds system try open season-round.

The newest financing are made to remind individuals buy land when you look at the rural portion. Nevertheless USDA’s concept of a rural town, no less than for its protected financing system, might possibly be much greater than simply you think it is. Usually, land for the suburban elements qualify for USDA finance. Truly the only areas that will be completely excluded are urban otherwise urban of those, when you learn you certainly need it when you look at the an excellent city, the brand new USDA mortgage program is generally from the dining table for you.