Envision a good 3% price with the an excellent $100,000 mortgage

The greatest economic purchase most homeowners accept is the real estate loans Woodmont no credit check loan, yet hardly any know just how mortgages try cost. The main element of the cost ‘s the financial interest rate, and is also the sole role borrowers have to pay regarding a single day the financing are paid into day it is totally reduced.

Definition of Interest rate

Mortgage ‘s the cost of money, and you may a mortgage loan interest ‘s the price of currency loaned up against the protection from a particular home. The interest rate is employed to calculate the interest payment brand new borrower owes the lending company.

The prices quoted by loan providers are yearly rates. Of many home mortgages, the attention percentage is calculated month-to-month. And this, the speed is separated by a dozen ahead of figuring the fresh new commission.

For the decimals, 3% was .03, of course split from the twelve its .0025. Proliferate .0025 moments $100,000 while rating $250 as monthly desire payment.

Desire or other Loan Costs

Attention is only one part of the price of a home loan with the borrower. They also shell out two categories of upfront charges, you to stated in dollars which cover the expenses out-of specific functions such label insurance, and one said just like the a percentage of your own loan amount and this is called points. And you may borrowers that have brief down money in addition to must pay a mortgage advanced that’s paid down throughout the years just like the a component of this new monthly homeloan payment.

Rate of interest and Annual percentage rate

When you find a mortgage rate of interest, you are likely and to get a hold of an apr, that’s more often than not a small greater than the speed. The fresh Apr ‘s the home loan interest rate modified to provide every one other financing charges quoted from the paragraph more than. Brand new formula assumes on your almost every other costs is pass on evenly more than living of one’s home loan, which imparts a lower bias to the Apr into the any financing and that is completely paid down in advance of name that’s a lot of them.

Monthly Focus Accrual Rather than Daily Accrual

The high quality home loan in america accrues desire month-to-month, meaning that the number owed the lender are calculated 30 days at a time. There are a few mortgage loans, yet not, about what attention accrues every single day. New yearly price, instead of getting divided by the a dozen in order to estimate month-to-month attract try separated by 365 to help you assess everyday attention. Speaking of titled easy desire mortgages, I have found you to consumers with one have a tendency to do not learn he has that up to it find that its mortgage harmony isn’t really decreasing the way it carry out towards a month-to-month accrual home loan. Effortless notice mortgage loans certainly are the source of many problems.

Repaired As opposed to Varying Rates of interest

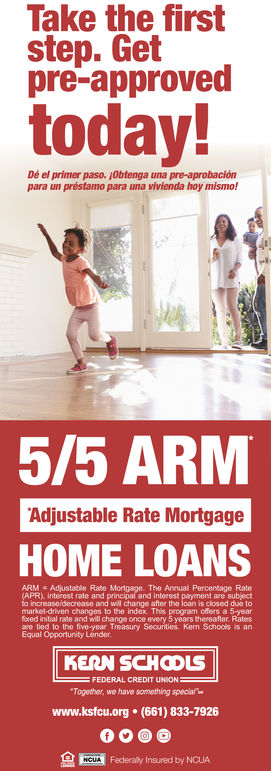

A mortgage on which the interest rate is set to your life of the mortgage is called an effective fixed-price financial or FRM, while you are a home loan about what the rate can alter try an varying speed home loan otherwise Arm. Fingers usually have a fixed rates months at the beginning, that will range from half a year in order to ten years. The interest rate changes ability of an arm makes it a lot harder than a keen FRM, this is the reason of numerous borrowers wouldn’t imagine a supply.

The dwelling off Financial Rates of interest

Into virtually any day, Jones could possibly get spend a high home loan interest than Smith for all pursuing the grounds:

- Jones paid back a smaller origination commission, possibly finding a negative percentage or discount.

- Jones got a substantially all the way down credit score.

- Jones was borrowing from the bank with the a residential property, Smith with the an initial household.

- Jones’ assets have 4 hold products whereas Smith’s is unmarried friends.

- Jones is actually taking cash-out away from good re-finance, while Smith isn’t.

- Jones demands a good sixty-date rates lock whereas Smith requires only thirty day period.

- Jones waives the obligation to keep an enthusiastic escrow membership, Smith doesn’t.

- Jones allows the borrowed funds administrator to talk your for the a high rates, if you’re Smith doesn’t.

All but the very last items is actually legitimate in the sense you to if you shop on the-line at a competitive multiple-bank site, eg mine, the values will vary in how expressed. The last items is required to complete the number because the of a lot borrowers put on their own at the mercy of just one mortgage administrator.

Changes in Financial Interest levels

Really this new mortgages can be bought in the supplementary markets following are signed, in addition to prices charged consumers are often considering latest second industry costs. Plain old routine is to try to reset the rates each and every morning centered toward closure pricing about second business the night before. Label these types of the newest lender’s published cost.

The new posted price relates to prospective individuals who were cleared to lock, which necessitates that its loan requests have been processed, this new appraisals bought, as well as needed documentation done. This will take weeks on the a beneficial re-finance, lengthened toward property pick purchase.

To help you potential consumers when you look at the hunting form, a beneficial lender’s posted rate have minimal benefits, because it is not available to them and certainly will disappear right away. Posted costs presented to help you customers by mouth by mortgage officials are particularly suspect, just like the a few of all of them understate the cost so you can induce the fresh new buyer to return, a practice titled low-balling. The only safe answer to shop published costs is on-range from the multi-financial internet sites such as for example mine.

- Discovered His Help in Choosing the Form of Home loan You to Most readily useful Suits you