Georgia mortgage loans to have basic responders that have poor credit

USDA financing to have GA basic responders

USDA Rural Creativity earliest responder home loans in Georgia are formulated to prompt individuals transfer to outlying aspects of the world. Just as much as 97 percent regarding result in the state is eligible to have this kind of mortgage, thus envision implementing even though you imagine you live in a good suburb out of a large city!

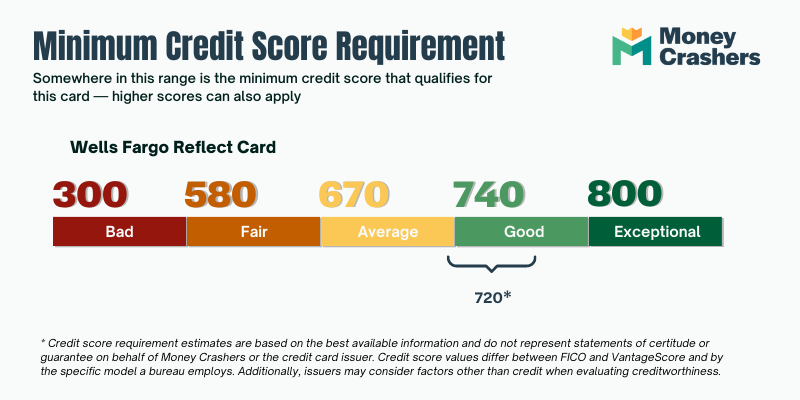

USDA funds are not quite as obtainable because the FHA finance, but they can save you money in the near future. The common regards to a good USDA financing within the Georgia is low in order to zero advance payment, at least credit score of 600, lower than 115 per cent of your own median earnings for the city, and you will antique Personal Home loan Insurance payments. USDA funds usually also have some of the reduced rates of interest around.

Your credit rating is seen as the ultimate way of measuring their economic obligation. When you yourself have poor credit, it ways to home loans from inside the Georgia that you could perhaps not pay back the cash they provide both you and will make it far more challenging to help you secure a beneficial financial.

Obviously, we realize you to sometimes poor credit happens to an effective some one. Very besides capitalizing on FHA and you can Va mortgage brokers, here are some additional options to pursue inside the you are searching for very first responder mortgage brokers inside the Georgia along with poor credit.

Bringing approved

The easiest way to get a mortgage when you have poor credit is always to search the help of a co-signer. Shopping for an excellent cosigner is an alternative that is specifically popular with basic go out homebuyers, students, and you can newlyweds people that have to individual a home however, which will most likely not have experienced for you personally to generate a good credit score.

A beneficial cosigner’s credit rating will boost your individual, letting you incorporate like you really have ideal credit than simply you actually create. This will lead to best https://paydayloanalabama.com/fayetteville/ conditions, lower down costs, and you will a far greater danger of bringing acknowledged. You are able to come across an excellent cosigner having an FHA or Va financing to keep so much more money!

Although not, the fresh cosigner might be absorbing most of the exposure by the attaching their credit to your property. Oftentimes, they may be reached and come up with repayments for people who skip an excellent few days.

Thus make sure that your cosigner is actually someone you can trust and that they trust you reciprocally in advance of stepping into so it sort of contract!

One more thing to remember would be the fact home loans can be manually underwrite the standards to your a mortgage. To enable them to decrease the borrowing conditions or eliminate brand new deposit totally.

They often merely accomplish that for the special cases, and regularly wanted proof that current financial situation is not your fault, nonetheless they could be willing to bring special said so you’re able to Georgia earliest responders. Speak with your own financial now and see what they is going to do to you!

Dealing with Brand new Downpayment

Many people realize that the most challenging part of purchasing a house was affording the latest steep downpayment. This is especially valid when you find yourself seeking earliest responder lenders in Georgia which have poor credit.

A less than perfect credit house consumer can be regarded as a high chance, very though it is an FHA mortgage, lenders will assume that create increased down-payment so they be aware that might generate at the very least particular of the cash return beforehand.

This is how you could begin needing to glance at the downpayment recommendations programs offered by the state. For individuals who get a Georgia Dream Home loan from the Georgia Institution out-of Society Situations (GADCA), the state will pay to $7,five-hundred of the advance payment to you so long as you still pay at least $step 1,000 oneself.